Fund insights

Our latest comments and analysis on key investment topics and markets

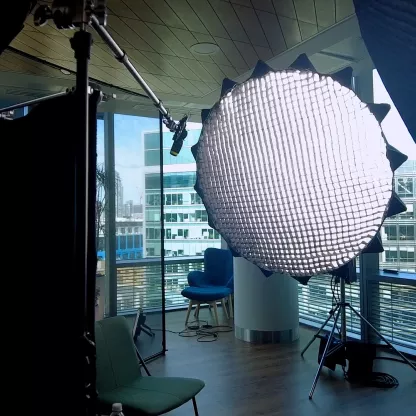

Join Rathbones Asset Management fund managers as they discuss how they’re navigating market challenges and finding opportunities, outline fund performance and positioning and explain how they see the world.

In Conversation September 2024

The latest edition of In Conversation is here.

Since our last series, markets have been buzzing with activity and significant developments.

Our fund managers break down these events and discuss how they’re navigating this complex environment. They offer their perspectives on what lies ahead and how they are positioning their portfolios for the challenges and opportunities that the rest of 2024 might bring.

1 min

In Conversation January 2024

The latest edition of In Conversation has arrived. Our managers explain how they are navigating current challenges and finding opportunities, they also outline fund performance, positioning and what they believe lies ahead.

1 min

In Conversation September 2023

The latest edition of In Conversation has landed. Our managers explain how they are navigating current challenges and opportunities, outlining fund performance, positioning and what they believe lies ahead.

1 min

In Conversation February 2023

Join head of regional sales Ben Johnson as he introduces the latest In Conversation series. This series of video updates are here to provide you with the most up-to-date insights; portfolio positioning, performance and outlook.

For Financial Advisers Only

1 min

In Conversation September 2022

The latest series of ‘In conversation’ has landed. A lot has happened since our last fund updates: find out how our fund managers have been positioning their funds, navigating challenges and seeking out opportunities.

1 min

In Conversation January 2022

Much has happened since our last series. COVID-19 threw us another curveball with Omicron spreading fast. This aggravated existing supply chain and employment issues, fuelling inflation and political instability. Central bankers are under pressure to tighten monetary policy earlier than expected. So, what does this all mean for investor sentiment?

1 min

In Conversation September 2021

Much has happened since our last series. The world is largely open again, though the highly contagious delta variant and supply chain disruptions mean life is far from ‘back to normal’.

1 min

In conversation - February 2021

Much has happened since the last time they spoke to you. Lockdown 2.0; Lockdown 3.0; a post-Brexit trade deal with the EU; Joe Biden became president; and the beginning of a global vaccination drive.

1 min

In conversation - October 2020

Now in its second iteration, our In conversation series is beaming from the homes of our managers for the first – and likely not the last – time. They have provided the latest fund performance, portfolio positioning and their views on the future.

1 min

In conversation - February 2020

Introducing the, “In conversation” series, you’ll have the opportunity to hear and now see our fund managers provide their expert view in a short, engaging and digestible format. We aim to run these updates twice a year.

1 min

Asset TV is a leading research and learning platform for investment professionals. Watch Rathbones Asset Management fund managers as they discuss a wide range of topics with panels of industry experts.

Keep up to date with the latest thinking and insights from Rathbones Asset Management’s fund managers. Register here for upcoming webinars or watch on demand.

Sleepless in Silicon Valley

Trying to unpick the turmoil in the banking sector, the team discuss what happened in the last week or so and what it means for the future, and explain what action they’ve taken as a result. Their gaze then shifts to our fair shores as they ask whether, after a few years in the investment wilderness, the UK could be on the precipice of some structural changes that might support the economy and perhaps the equity market too.

2 mins

Love Satchually

Could David’s usual prediction of US stocks beating European ones come a cropper this year? The team also explain why US real estate investment trusts are a different ball game for them vs the UK market, and where there are some exciting opportunities. Finally, the team turn a loving, Valentine’s Day gaze towards European luxury goods giant LVMH and discuss just why the company’s resilient earnings are perhaps worth paying a pretty penny for.

2 mins

Rathbone Fixed Income webcast | March 2023

1 min

Multi-asset webcast | February 2023

1 min

A Lidl less compensation

The team kick off 2023 discussing the outlook for the year ahead: what stays the same, what changes, and why it’s important not to overreact simply because there’s a new calendar adorning our desks. They also discuss whether consumers trading down in household staples will mean less-resilient revenues, and why they think global skincare and cosmetics giant Estee Lauder presents a different story to its peers.

2 mins

The quotes of Christmas past

Join the whole Sharpe End team for the Christmas special edition where Craig, Rahab, and Will hold David to account for his predictions for 2022. Just how well did David call the fortunes of the UK economy? How accurate were his views on speculative technology and cryptocurrency? And, importantly, did he beat last year’s score of 4.5 points!?

2 mins

QuidDitch

The team ponder whether, after the not-so-mini reaction to the Chancellor’s ‘mini-budget’, it’s finally time to buy UK bonds again or whether US Treasuries still look a better place for capital, and explain how they are tackling currency exposure in the face of a continually volatile pound. Also, what does the return to a world of higher costs of capital and risk-free rates mean for markets, and how should it change how we invest?

2 mins

Rathbones multi-asset investment update | October 2022

Fund Manager Will McIntosh-Whyte, Rathbone Multi-Asset Portfolios and Rathbone Greenbank Multi-Asset portfolios, will give an update on the funds and discuss some of the topics that are front of mind.

1 min

The Jackson Dive

Have US Fed Chair Jerome Powell’s comments at Jackson Hole spooked the team as much as they spooked the market? This month, David, Will, and Craig also discuss how much attention to pay to the weakening US housing market, and finally touch on the video game industry and how it should remain an exciting place to invest for many years to come.

2 mins

Penny Drain

We may have (finally) reached peak inflation, argue David, Will and Rahab this month. Also, they explain how the Tory leadership campaign made them reassess the benefits and pitfalls of deregulation, and why they think water is an exciting investment theme for their portfolios.

2 mins

Feeling the Pinch

This month, David, Will and Craig discuss the wide-ranging impacts of the energy market’s current stresses and complexities. Also, despite some expected post-pandemic catch-up in consumer services spending, the team aren’t tempted by many businesses that have benefited. Finally, they discuss the departure of Prime Minister Boris Johnson in real time and what it might mean for fiscal policy and the UK economy.

2 mins

Rathbones multi-asset investment update | July 2022

In the final webcast before the summer holiday season, David Coombs, head of multi-asset investments and Will McIntosh-Whyte, fund manager, will be providing a multi-asset team update covering:

- Is recession in the US now a foregone conclusion?

- Will the US Federal Reserve need to cut rates in 2023?

- Are cyclicals a help or hindrance in the current inflationary environment?

- Are consumer staples the best form of defence in a slowing economy?

- How the team are approaching managing the portfolios in this volatile market.

1 min