The transformation of landfill gas from climate-impacting pollutant to useful, renewable fuel sounds too good to be true. It’s not an easy path, notes sustainable equity analyst Neil Smith, but one company has found the treasure map.

Waste Not, Want Not

“One man’s rubbish is another man’s treasure” takes on a more literal meaning for the waste industry that’s responsible for dealing with our throw-away culture. If you rummage through your own cast-offs, it’s easy to spot the obvious treasure: materials like plastic, glass and cardboard which can be collected, sorted, and resold at a profit to companies who can recycle and reuse them in their products and packaging.

There’s also a less obvious bounty that comes from the rubbish that can’t be recycled, from all the bits condemned to landfill. These sites are where trash is buried to allow it to break down and degrade. In the past, these sites could often be environmental hazards, particularly as they throw off large amounts of methane and carbon dioxide. Methane gas in large quantities can be harmful to people and animals. It’s also extremely flammable. And methane and carbon dioxide are both powerful greenhouse gases that contribute to climate change.

However, there are waste operators that are managing landfills in a more responsible way. And they have found a way to make use of the gas generated from biodegradation at their sites, capturing it and using it as a low-carbon fuel to power trucks and generate electricity.

The good gas

Globally, we generate a lot of solid waste: 2.1 billion tonnes in 2023, predicted to grow to 3.8 billion tonnes by 2050 according to the UN environment programme’s global waste management outlook 2024 report. Landfill sites operate by crushing and compacting waste, depositing it underground, and leaving it there to decompose over time. It can take years for this waste to decay, and the process produces a biogas composed of roughly equal parts methane and carbon dioxide, major contributors towards climate change and global warming.

Stopping the release of these gases into the atmosphere is vital and landfill sites have been evolving to tackle the challenge. Daily covering and better sealing of landfill can keep most of the greenhouse gases locked inside. Wells and pipes can then direct the gas to a central processing facility where it can be processed to isolate the methane and remove other impurities to make it suitable for combustion. Burning (known in the industry as flaring) in sufficient oxygen converts the methane gas into carbon dioxide and water, preventing the more harmful methane from entering the atmosphere; but that still leaves more carbon dioxide. Industry (and wider society) are asking if there’s a better use for this gas.

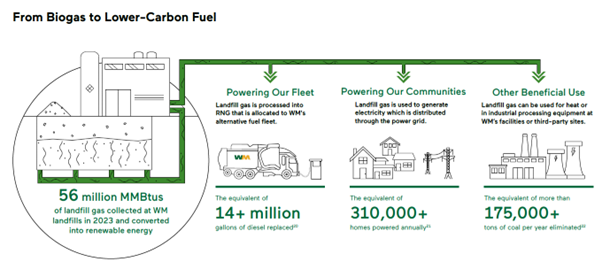

A company at the forefront of the landfill evolution is US-based Waste Management, which we own in several funds. The company has an abundance of biogas as it owns and operates the largest network of landfills throughout North America. One reason we bought into this business was because of the opportunity it has in converting biogas into renewable natural gas (RNG). At an investor day back in 2023, Waste Management highlighted how it expects its landfill sites equipped with RNG plants to be a key growth driver, combining increased profitability and improved environmental performance. As of 2023 the company had successfully captured 80% of the landfill gas produced at these sites. Of this gas captured 57% was flared leaving 43% for three different beneficial uses.

Source: Waste Management; 20 MMBtus of renewable natural gas generated converted to diesel gallons equivalent using conversion factors from Argonne National Laboratory, 21 MMBtus of landfill gas generated for power is converted to state-average household electricity consumption based on US Department of Energy data; 22 MMBtus of landfill gas generated for other beneficial use include on-site leachate processing and other industrial applications. Gas volumes are converted to equivalent tons of coal based on heat content.

The green treasure hunt

The first immediate benefit is the use of this converted biogas to power some of Waste Management’s fleet of collection trucks. The company’s own environmental footprint is reduced as RNG emits less greenhouse gases than using traditional diesel fuel. Almost half of its fleet now runs on RNG, making it the largest alternative fuel fleet in the waste industry.

The second beneficial use for RNG is generating electricity with gas turbines. The historical feedstock of these gas turbines has been natural gas, a fossil fuel found deep underground. Extracting this gas is no easy task and involves drilling and fracking which hurts the environment in many ways. It requires significant amounts of water, leaks methane gas into the atmosphere, and increases seismic activity which can lead to earthquakes and destruction of local ecosystems. RNG combustion is an easy and more environmentally friendly alternative.

Finally, RNG is a bona fide fuel in its own right. It can be piped directly into boilers or kilns of other businesses, to be used across various industrial processes or heating applications. RNG is a more environmentally friendly feedstock for generating heat than fossil fuel alternatives such as natural gas, oil and coal.

In the US this amazingly flexible fuel is in high demand, and supply isn’t estimated to catch up until 2030. As a result, Waste Management is on a drive to increase its production of RNG to deliver to this market. The company is investing over $1.4 billion between 2022 and 2026 to build 20 new facilities that will convert its captured landfill gas into pipeline-quality RNG. With these new facilities coming on line, by 2026 the company aims to use at least 65% of its captured landfill gas in powering its trucks, generating electricity for communities or creating renewable biogas for customers. That would be a 22-percentage-point increase from 2023. Now that the waste industry has found the treasure map it has led directly to its landfill sites. It’s now just a matter of extracting this gassy treasure and putting it to good use.