Last month’s banking sector volatility rattled investor confidence in some bank bonds. But, as fixed income fund manager Stuart Chilvers argues, there’s still a compelling case for investing in higher-quality corporate bonds.

Three reasons to stick with investment grade corporate bonds

By and large, corporate bond markets are steadying again after the shockwaves triggered by the collapse of three US regional banks and Swiss banking giant Credit Suisse. Credit Suisse’s demise was particularly unsettling since, as we explain here, it involved Swiss regulators’ controversial decision to wipe out the value of its Additional Tier 1 (AT1) bonds, a form of debt issued only by banks to bolster equity when they get into trouble. This decision triggered significant volatility in the broader AT1 market, although it has since eased somewhat after UK and EU regulators reassured investors that shareholders would take losses before AT1 bondholders if a bank ran into similar problems in either the UK or the EU.

In our view, investing in higher-quality (investment grade) corporate bonds still looks like an attractive opportunity for several reasons.

Three of the most important include:

1. Investment grade bonds offer juicy yields

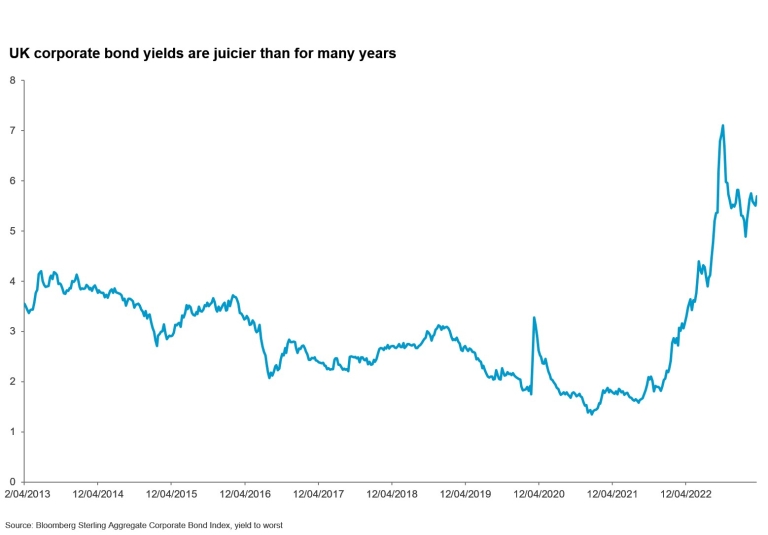

Over the past decade (up to the beginning of 2022), the yields to maturity on many investment grade corporate bonds were pretty meagre. At the extreme, this drove some investors to question the value of including investment grade bonds in their portfolios since some equity indices offered dividend yields in excess of the income yield from sterling corporate bond indices.

All that changed last year. Government bond yields rose significantly in 2022 as it became clear that inflation was proving far stickier than had been widely expected and the world’s biggest central banks hiked interest rates aggressively. As a result, corporate bond yields jumped too. In addition, credit spreads (the additional return investors receive relative to government bonds for taking on the default risk of the corporate issuer) widened significantly as worries about the economic outlook mounted. This was in no small part because of concerns about how much higher rates would slow down growth. The net result of these two moves is that the yield on broad sterling investment grade corporate bond indices recently reached its highest level in over a decade. It’s fallen back a bit recently, but it’s still at levels we haven’t seen in the past decade bar the past few months. Newly issued bonds are now sporting very sizeable coupons: for instance, we saw large, frequent investment grade issuers come to market with bonds in 2022 with coupons north of 7%.

2. High-quality borrowers are largely in solid shape

We don’t expect all bonds to perform well from here. Given the tough economic backdrop, we think companies will start downgrading their earnings estimates. Some high-yield bond issuers (i.e. companies with lower credit ratings because they’re deemed at greater risk of defaulting on their debt repayments) may well come under pressure.

But investment grade borrowers are in a stronger position and more likely to be able to endure a period of economic weakness without debt affordability becoming a significant issue. This suggests to us that we probably aren’t going to see a big spike in defaults from higher-quality borrowers even if the broader economic backdrop gets worse. And, when we look at credit spreads on sterling investment grade bonds compared with their historic levels, some economic weakness is priced into these spreads.

3. Investment grade credit typically does well when rate-hiking cycles end

The gap between a cycle’s final rate hike and the moment when equity markets trough has been variable (depending on the outlook for economic growth). But high-quality investment grade bonds have tended to start doing relatively well pretty much straightaway as they’re much less sensitive to companies’ profit cycles. For equities, there’s a trade-off between ‘slower growth is bad’ and ‘the end of rate rises is good’.

It seems increasingly likely that we’ll reach the peak of the rate hiking cycle in coming months. And, of course, now that corporate bond yields are much juicier, they provide a more solid buffer against any price volatility if rates go higher – and stay higher – for longer.