Our Rathbone Global Opportunities Fund manager James Thomson celebrates a phenomenal 20 years at the helm this November. He looks back and wonders about his youthful exuberance.

A Special Thanksgiving

Being schooled in the ways of America, despite not being American, it’s fitting that I took the reins of my fund in the month of Thanksgiving 20 years ago. It means there’s an annual milestone already etched in my upbringing that encourages me to reflect, give thanks for the blessings I have and take the time to remember what has passed.

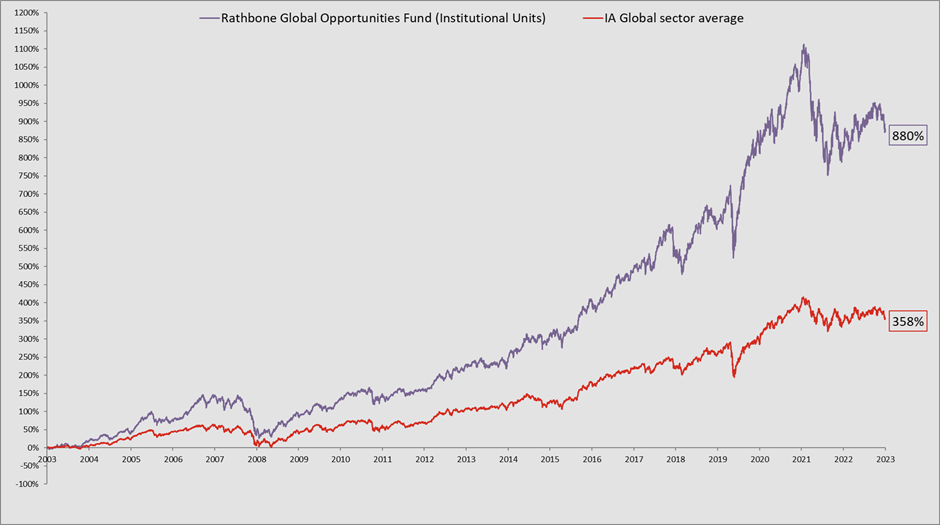

This Thanksgiving is a big one. I have managed my fund for 20 years. In some ways it’s my first born. The fund has grown from under £5 million in 2003 to almost £3.3 billion and returned 880%. It has greatly outperformed its peers, as you can see in the chart below, and is ranked number one in the IA Global sector over that period. Of course, past performance shouldn’t be seen as an indication of future performance, but I am proud of my record over this time and hope to continue delivering in the next 20 years.

There have been a few big successes over the years. Some of the largest contributors to our fund’s success were buying UK property website Rightmove, international payments giant Visa and ecommerce and cloud-computing business Amazon. We bought all three back in the dark days after the Global Financial Crisis (GFC) and have held them ever since while they have soared well above their indices.

20 years on

Source: FE Analytics; I-class performance from 1 November 2003 to 31 October 2023

The value of investments and the income from them may go down as well as up and you may not get back what you originally invested.

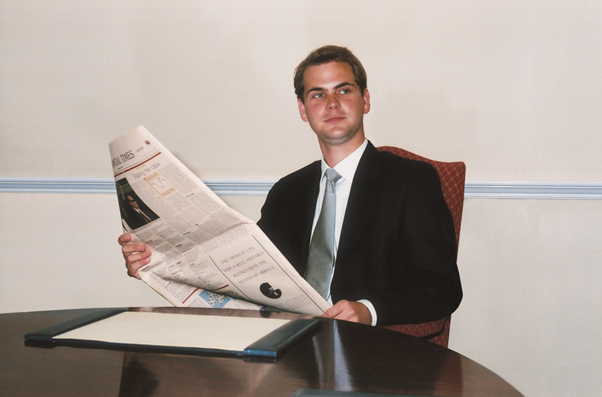

That’s not to say there haven’t been mistakes and setbacks. A casual comparison of my current headshot with the cocky, naïve boy manager you see reclining in the picture below will show you the ravages of my time in the markets. Never in a million years was that picture a good idea.

There were some poor investment decisions as well: some stocks I’d rather were forever forgotten, yet haunt me with valuable lessons that are still relevant today. These mistakes led me to create a list of ingredients to avoid putting into the ‘Secret Sauce’ of the fund:

- Traumatised businesses that need major work to be turned around

- Vulnerable industry leaders that are making outsized profits while resting on their laurels and not improving what they sell

- Disruptive, unconventional and untested technology – like Prometheus’s fire, radical technology often burns those who wield it as well as their wider industry

- Speculative ventures that are immature and yet to prove how they can make money and grow

- Companies that aren’t in control of their destiny, but instead are reliant on the wider economy or commoditised markets to boost profits

- Hyped industries that are susceptible to a flood of entrants, causing oversupply and eventual price collapse

- Cheap, awful companies whose sole attraction is their ridiculously low price – yes, they can always get cheaper

There were some periods of bad all-round performance as well. The worst being the crash following the GFC which made my fund lose almost 40% in 2008. I hadn’t felt the wind change at all and I’d taken too much risk at precisely the wrong time. I still carry the scars today. It’s why I spend much more of my time thinking about my portfolio as a whole and how common characteristics of the stocks I really like can amplify the risk of big falls in the fund’s value. Much more than the pre-GFC me who was simply excited about finding the Next Big Thing.

Thankfully not all my decisions have aged as terribly as that photo my marketing team won’t let me forget. Over the past 20 years, my fund has averaged a compound annual return of 12%. The brutal 12-month GFC course in humility led to portfolio changes that have clipped the upside at times, but I think it also explains why I’ve outperformed my peer group for 17 out of the past 20 calendar years (the exceptions were 2008, 2016 and 2022).

Don’t worry. While I may be much older, I’m still excited about finding truly amazing businesses that can grow quickly, dominate their industries and change how we live our lives while delivering big rewards for investors.

But there’s also an appreciation to all the people who support me in running my fund. And it has grown with every day that passes. I’m so very thankful to the investors who gave me the immense responsibility of investing their money – both to the much younger me and those who put money in the fund today. And I’m thankful to the colleagues who support me every day in doing what I love.

Happy Thanksgiving, and here’s to another 20 years!