It can be hard to spot the time flowing by as the days roll into weeks and months into years, laments multi-asset fund manager Will McIntosh-Whyte. And you’d better be careful, he warns, because inflation works just the same way.

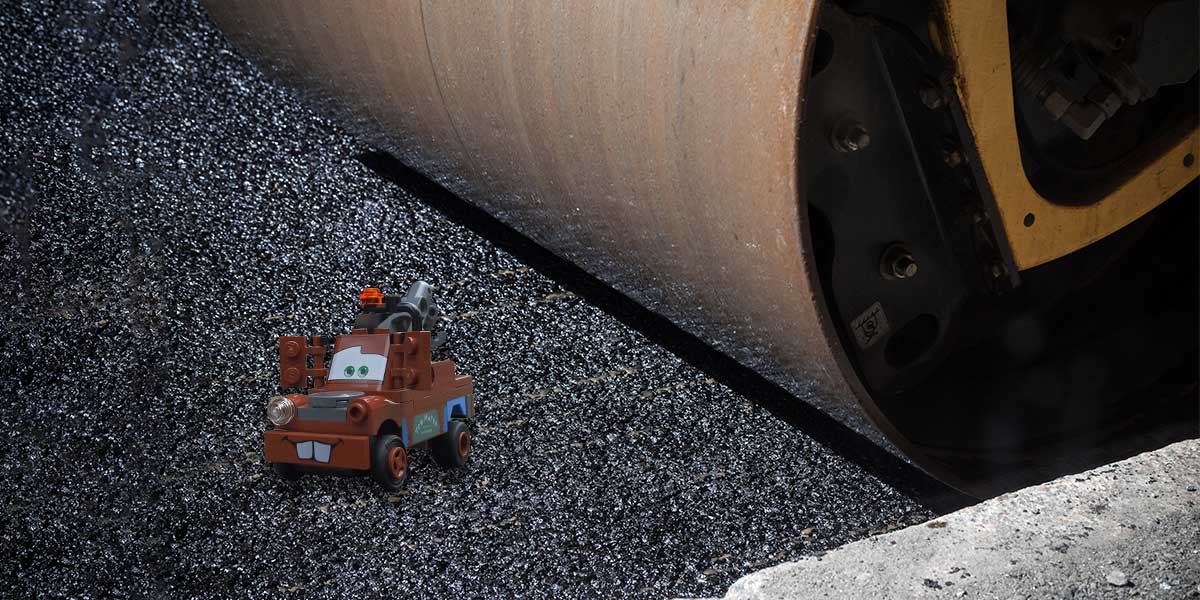

Roadkill II

A friend of mine recently remarked that for the first time she had started to feel like an adult – started to “feel old”.

It wasn’t related to any specific event. She got married the better part of a decade ago, has two kids, a mortgage and has had a number of careers. But recently something has changed. Getting old happens gradually and then it shocks you. Like absentmindedly filling a glass until it suddenly overflows. Ageing is not really something you notice on a day-to-day basis. You get up every day and the guy in the mirror is identical to the one who was looking back at you yesterday.

But then you go on holiday and someone shows you a video from your first boys’ trip away to Kavos (you didn’t know any better), and it becomes immediately apparent just how much you really have aged! I’ve not looked at myself in the mirror the same since. It’s only when you step back and take a minute to think about it that you notice getting old. And our steady march to the grave isn’t something you really want to think about!

In a similar way, I often think that investors can too often get caught up in the day-to-day and forget about taking the long view about what they are trying to achieve. Back in June I wrote about currencies and how risk is often hidden and unquantifiable. But sometimes you can put clear numbers around it: government bond yields have fallen substantially this year, accelerating in recent weeks. If you buy a 10-year UK government bond today and hold it to maturity, you will earn 0.5% per year. Assuming the UK government doesn’t default, that is a known return, and you shouldn’t lose your money.

However, there is so-called ‘mark-to-market’ risk – if you want to sell early, you may find the price is much different. Fears of higher inflation, loose fiscal policy or an untrustworthy government could send bond yields rising. If they went back toward the levels seen as recently as October last year, investors could find the value of these bonds falling over 10%. Not great for the ‘safe’ part of your portfolio. There is a famous phrase, “Picking up pennies in front of a steamroller,” which refers to taking significant risk for small return. Could that describe investing in government debt today? Interestingly, German 10-year government bond yields are negative 0.5% a year if you hold it for the next decade. That’s presumably akin to putting down pennies in front of a steamroller.

We do own some gilts in our multi-asset portfolio funds, although more recently we’ve been buying shorter-dated gilts and T-bills – the latter currently gives you a 0.7% annualised return. That’s 20 basis points more than the 10-year’s return from something that is basically cash. Government bond prices tend to go up when equities are selling off, so they can play an important part in portfolio construction. But you must be wary of buying these instruments at any cost, and so rather than buying more government bonds at these levels, we have been reducing our exposure, and buying more put options as we look to protect the portfolio in the most cost-efficient manner we can.

Equally, for those with a long-term investment horizon, packing your portfolio with 10-year bonds, it’s important to remember that if UK inflation remains at 2% over that time, you will lose nearly a sixth of the real value of your capital. As with ageing, this process is glacial and barely noticeable day to day. But, like a terrible video from a Mediterranean time capsule, the consequences may shock you many years hence.

In The KNOW blog is going on a summer holiday and will be back with you early September.