The success of new GLP-1 diabetes and weight-loss treatments might be just the beginning, writes sustainable investment analyst Neil Smith. An exciting new world of second-generation treatments are already being researched and trialled.

Developing the world’s first weight-loss cocktail

Next-generation diet drugs that help prevent and manage diabetes are already improving millions of lives and shaking up markets.

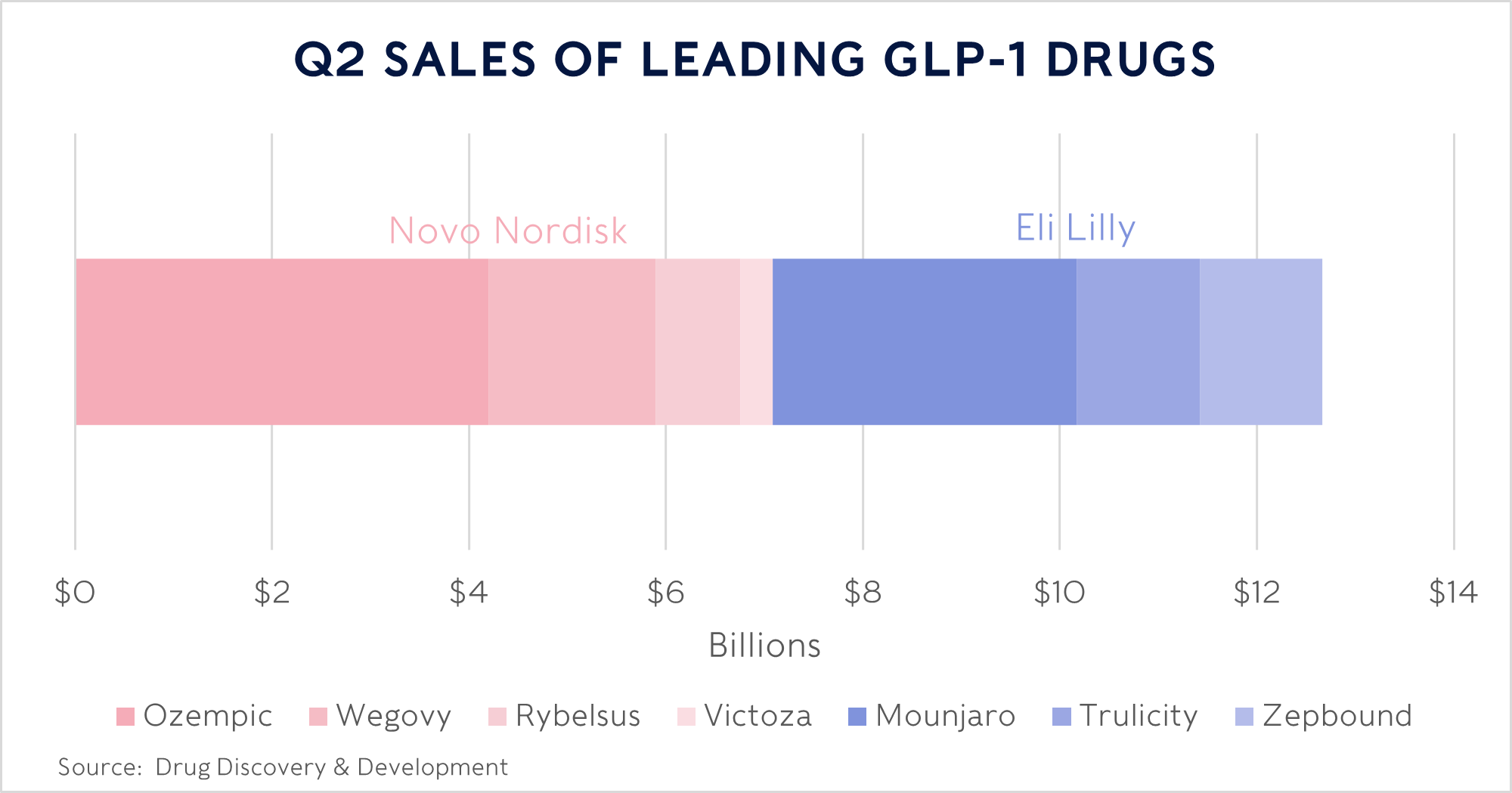

The use of drugs that mimic the glucagon-like peptide-1 (commonly known as GLP-1) hormone is growing rapidly. GLP-1 occurs naturally in your gut after eating. It helps the pancreas produce insulin, which brings down blood sugar levels. Leading the charge in the rise of these GLP-1 treatments are American pharmaceutical company Eli Lilly (which we own in our Rathbone Greenbank Global Sustainability Fund) and its European rival Novo Nordisk (which we don’t).

We own Eli instead of Novo, which has a bigger market share, because we think its active ingredient, tirzepatide, is the better product. We believe that should help Eli overtake Novo’s lead and maintain a dominant position in the diabetes and weight loss drug markets for years to come.

Eli uses tirzepatide in two ways: the drug Zepbound is prescribed for weight loss and needs a higher dosage of tirzepatide when compared with Mounjaro, which helps to manage diabetes. Higher dosages tend to come with a greater incidence of side effects experienced by patients. That can discourage people from sticking with the treatment, yet helping obese people lose weight before they develop diabetes is the best result for both the patient and our strained medical services. This is why Eli, Novo and others are already seeking out innovative hormone therapy combinations that are more effective, with fewer downsides. As the market matures, pharmacists and doctors should be able to perfect drug dosage, while patient lifestyle changes may also help minimise side effects.

… Lilly’s next step

We think Eli’s drugs are the best products on the market because tirzepatide is the first and only treatment that activates both the GLP-1 hormone and the glucose-dependent insulinotropic (GIP) hormone. We believe this dual mechanism gives Eli a key competitive advantage in diabetes treatment since it ensures it’s more effective in controlling blood sugar levels.

This breakthrough released a veritable genie from the bottle in terms of what the future may hold for these drugs. Recent research highlights the extensive array of hormone combinations that represent the next generation of therapies. One example is a novel combination with glucagon, another hormone in the pancreas that regulates blood sugar levels. Glucagon has the opposite function to insulin in that it helps keep blood sugar higher, while insulin lowers it. A ‘triple-agonist’ drug such as this, combining GLP-1, GIP and glucagon, could potentially work better than tirzepatide. This is because it would have the added of benefit of making patients feel more energetic, helping them change their lifestyles, become more active and burn more of their bodies’ fuel. All the while reducing their hunger levels and reducing their calorie intake.

In fact, Eli Lilly is already trialling this hormone mix in the form of retatrutide. Phase-two trial data has proved encouraging, with average weight reduction after 48 weeks of 24% on the highest dosage. Even more encouragingly, participants were still losing weight at the end of the study, so the full weight reduction is likely to increase further. This improvement in weight loss may mean that this type of treatment is a realistic alternative to bariatric surgery (where patients’ stomachs are made smaller so they feel full sooner and eat less food). Retatrutide has also been found to help other co-morbidities around obesity, with improvements observed in cardiometabolic measures, such as blood pressure and cholesterol. The phase-two data encouraged Eli to further explore the potential of retatrutide as a targeted and comprehensive treatment of obesity and its complications. Phase-three trials are already under way and are expected to conclude in 2026. After the third phase, a company can request approval from the U.S. Food & Drug Administration to sell the drug.

AstraZeneca throws its hat in the ring

Unsurprisingly, Eli and Novo aren’t alone in investing heavily in the research and development of the next wave of treatments in this area. UK-listed pharmaceutical giant AstraZeneca (another of our holdings) has bought the licensing rights for Chinese company Eccogene’s ECC5004 diabetes and obesity treatment.

This is an alternative GLP-1 drug that can be taken in pill form, rather than injected like existing GLP-1 drugs. ECC5004 has just finished phase-one tests (thus the snazzy name), so it’s quite far from market and there’s a good risk that it will come to naught. Yet a once-a-day pill is much more palatable to patients and easier to administer than a weekly injection. Also, the cost of production should be lower because the molecular makeup/chemistry makes it easier to produce. And there are no syringes or injector pens to add to the cost or cause delays in shipments.

All that could allow AstraZeneca to sell and distribute to lower and middle-income patients and countries, such as China, where the company has a strong presence. Finally, in phase-one of clinical trials it was found that the pill was rapidly absorbed by the body. Because it didn’t stay in the stomach for long it reduced the potential for side effects such as nausea, diarrhoea, vomiting and abdominal pain – issues associated with Novo and Eli’s weight loss drugs.

That chance of a credible, oral alternative with fewer side effects and a lower cost is why AstraZeneca took the gamble to back it. Phase-two trials are already underway and success is no foregone conclusion. In other trials, AstraZeneca had to scrap two GLP-1 drug candidates in early 2023, and commercially any new drug has a very high bar to clear if it’s to compete with Novo and Eli. However, AstraZeneca’s commitment to research in this area highlights its medical and commercial importance.

If successful, these drugs developed by Lilly, AstraZeneca and others could lead to an exciting new era of weight-loss solutions tailored to individual patient treatment needs. They would take into account the speed of weight loss required. But most importantly, they would address other co-morbidities that tend to go hand-in-hand with diabetes and obesity. These include respiratory and cardio-vascular diseases, kidney and fatty-liver disease and heart failure.

The endgame could be a whole suite of unique treatments and options for both patients and doctors from which to choose. Imagine the lives that can be improved and the money that could be saved.