Sticky inflation and wild swings in rate-cut expectations have tested investors’ mettle over the last few months. Assistant Rathbone Greenbank Global Sustainable Bond Fund Manager Christie Goncalves explains why she believes sustainable bonds could be one corner of the fixed income market offering welcome resilience.

Can sustainable bonds offer shelter from the storm?

Last week’s UK inflation numbers represent yet another bump in the sometimes painfully twisty route to lower interest rates. The Bank of England (BoE) had predicted that the latest UK consumer price inflation data would show it falling sharply from 3.2% to 2.1% – within striking distance of the bank’s inflation target.

In the event, it fell a bit less than the BoE had hoped and dropped to 2.3%. More worryingly for the central bank, services inflation (which measures prices driven mainly by the cost of employing people to deliver services like meals out or haircuts) is still running very hot at 5.9%. Services inflation is heavily influenced by wages so the BoE may worry that wage inflation is refusing to cool.

These inflation figures have dented hopes that BoE might cut rates in the early summer. Bond traders now think there’s less than a 50% chance the BoE will cut by August.

Uncertainty is driving extreme volatility

That represents yet another wobble in the seemingly endless ‘will they, won’t they?’ rate cut saga that has dominated central banks on both sides of the Atlantic. For months now, investor hopes about the timing of rate cuts have swung wildly and often. As a result, government bond markets have been more volatile over the last year than at any time since the Global Financial Crisis and the European Sovereign Debt Crisis.

By comparison, credit markets have been a lot steadier. The higher-than-expected inflation that’s pushing rate cuts further into the future shows that economic growth is holding up – and that’s positive for corporate bonds because it suggests we’re not lurching towards a harsh recession that might bring a deluge of corporate defaults and downgrades.

That’s ensured that credit spreads – the extra yield (or spread) that corporate bonds offer to compensate investors for default risks – have tightened a lot this year. But these spreads briefly widened last month (driving down corporate bond prices) when disappointments about the outlook for US rate cuts coincided with worries about escalating tensions in the Middle East.

Of course, bouts of volatility (big price movements) aren’t always bad news for investors with a longer-term view. They can offer terrific opportunities to take advantage of prices we think have dropped too much. And with bond yields much, much higher than they’ve been in decades, we are being paid ample coupon income as we wait for depressed prices to recover!

That said, we hope to avoid volatility maelstroms that drive big swings in the prices of our rate-sensitive government bonds and our growth-sensitive credit at the same time (which is why we hold a carefully balanced mix of both across our funds).

Are sustainable bonds more price-resilient?

So-called ‘labelled’ bonds (green, social and sustainability bonds issued by sovereign states, companies and other institutions to achieve specific environmental or positive objectives) and bonds issued by sustainable issuers are a particularly attractive corner of the broad fixed income universe, in our view. And one that seems likely to prove better shielded than most from big price swings. Why?

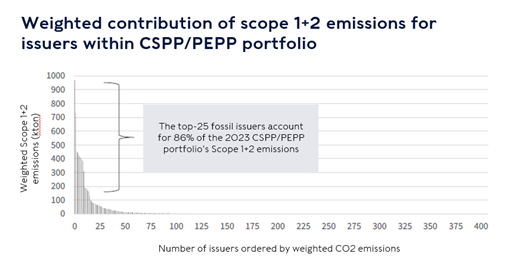

It’s all down to everyone’s growing appetite for these bonds. Essentially, demand for these bonds has stepped up big time as central banks have made it clear they want to hold more of them. The European Central Bank (ECB) announced last year that it intended to reshuffle its existing €370 billion bond holdings to improve their climate impact. As the chart below shows, a smallish number of issuers account for a huge proportion of its portfolio’s total emissions. If the ECB sells these high-emitting issuers’ bonds and buys more sustainable bonds instead, expect the prices of the former to come under pressure and those of the latter to get an extra boost.

Source: Bloomberg, Anthropocene Fixed Income Institute. Weighted contribution of scope 1 (direct) + scope 2 (indirect) emissions for issuers within ECB corporate sector purchase programme/pandemic emergency purchase programme bond portfolio

The BoE set out similar plans to the ECB a couple of years ago, through its commitment to greening its corporate bond portfolio to support an orderly economy-wide transition to net zero.

In addition to this, there are more and more mandates supporting green initiatives and sustainable themes as the focus on environmental, social and governance (ESG) issues grows. All this demand provides really important support for these bonds’ prices (something that’s known as ‘technical support’ in investing lingo).

That technical support seems likely to encourage more bond issuers to try to capitalise on it by issuing more labelled bonds and transitioning their business models to be more sustainably focused. We think it’s also likely to drive wider recognition of these bonds’ stronger resilience when markets go through bouts of volatility as the bonds will be held in ‘stable hands’.

All this reinforces our confidence that building a sustainable future and good long-term investment returns can go hand in hand.