As Halloween approaches, head of fixed income Bryn Jones takes on the guise of everyone’s favourite maths teacher to spook you all with a few charts.

Bonding Over Shared Scares

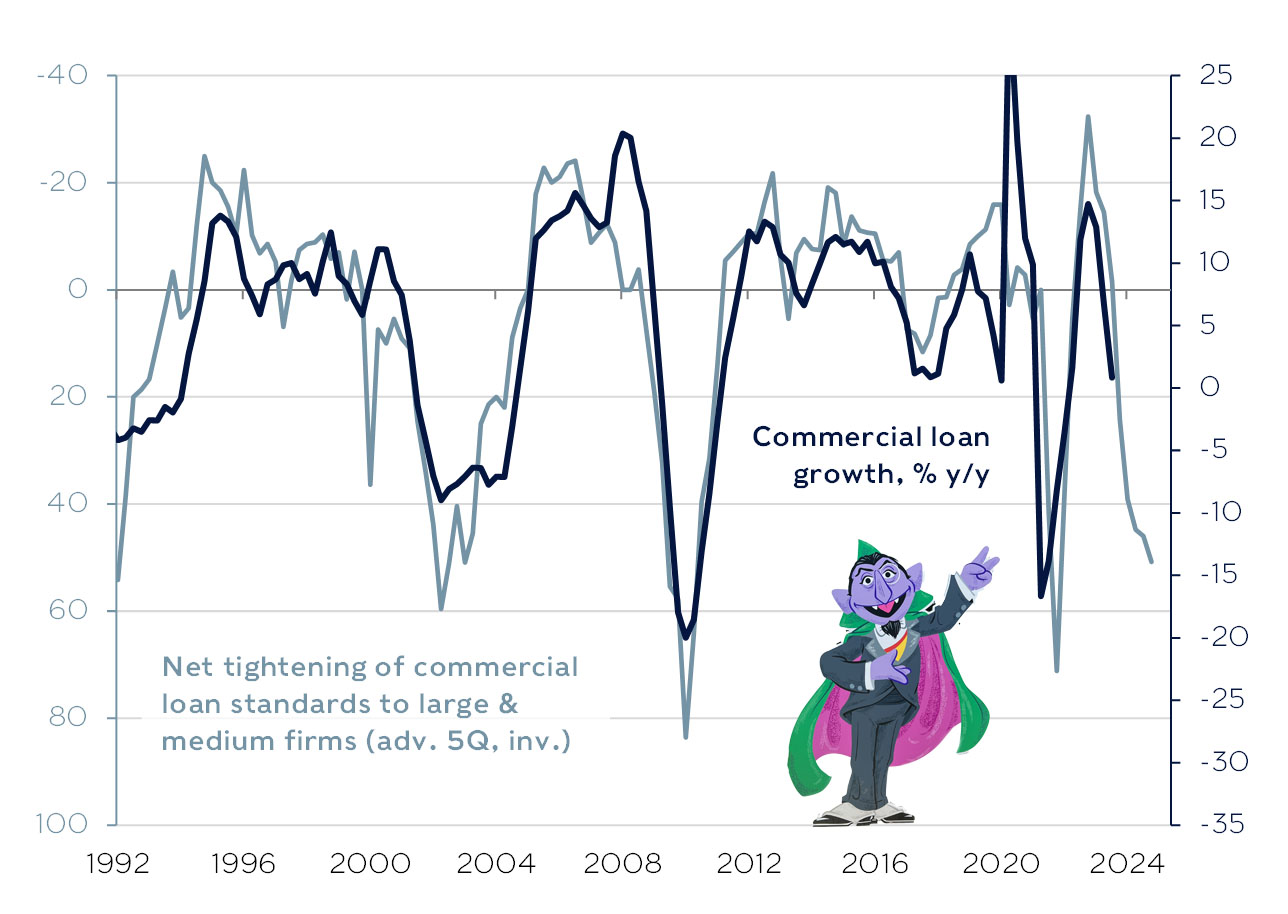

Growth in US business loans has been steadily dropping this year and is now virtually stagnant. Company borrowing tends to be heavily influenced by how strict banks are, although there’s roughly a five-month lag. This suggests lending will start to shrink sharply next year, as shown in chart 1, ah, ah, ha …

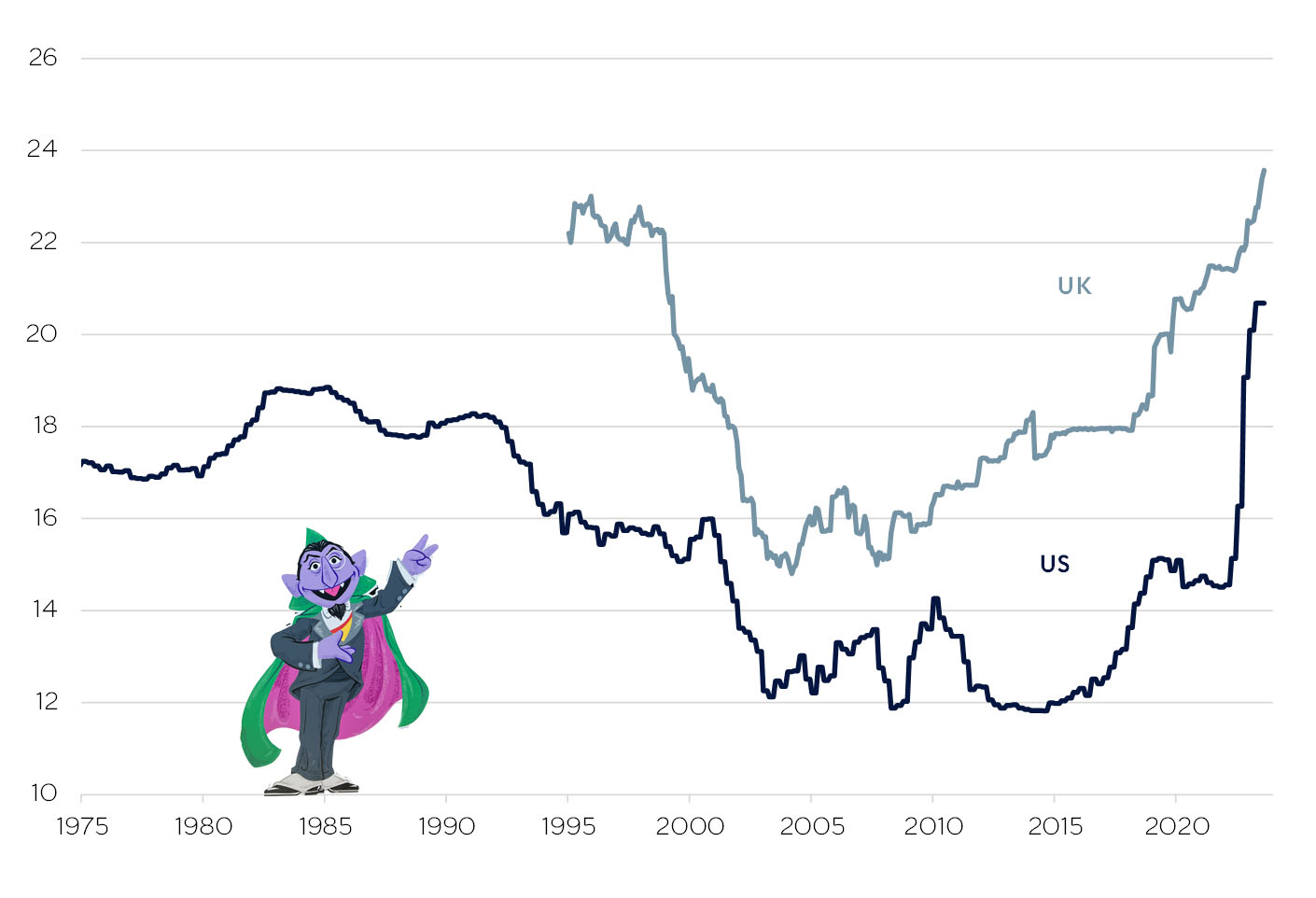

The tightening noose of lending standards

Source: Refinitiv, Rathbones

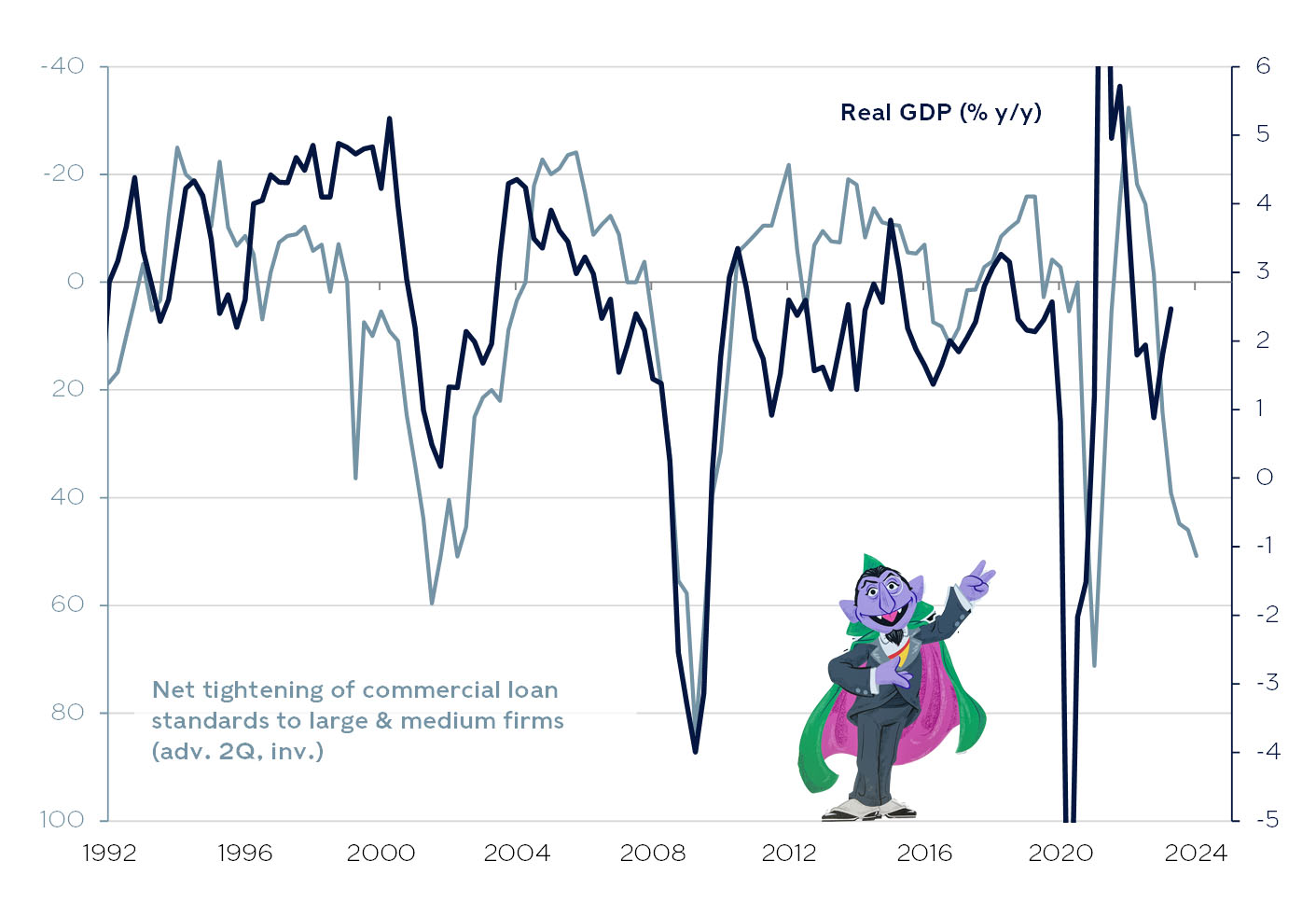

Less business borrowing tends to mean less investment in the economy as projects are shelved and companies hunker down, reducing overall activity. It tends to flow through to a slowdown in GDP growth, as shown in chart 2, ah, ah, ha …

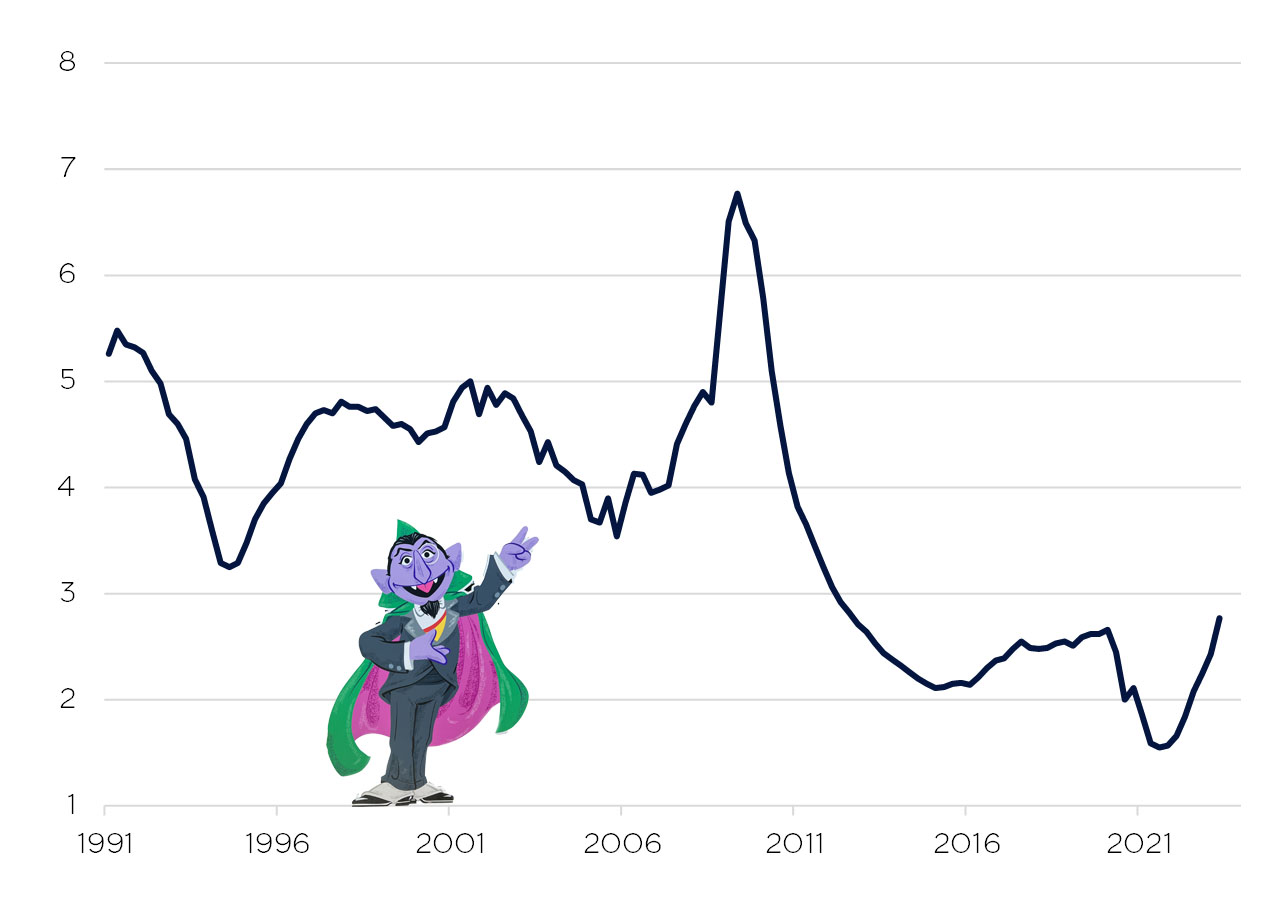

GDP usually falls six months after lending standards tighten

Source: Refinitiv, Rathbones

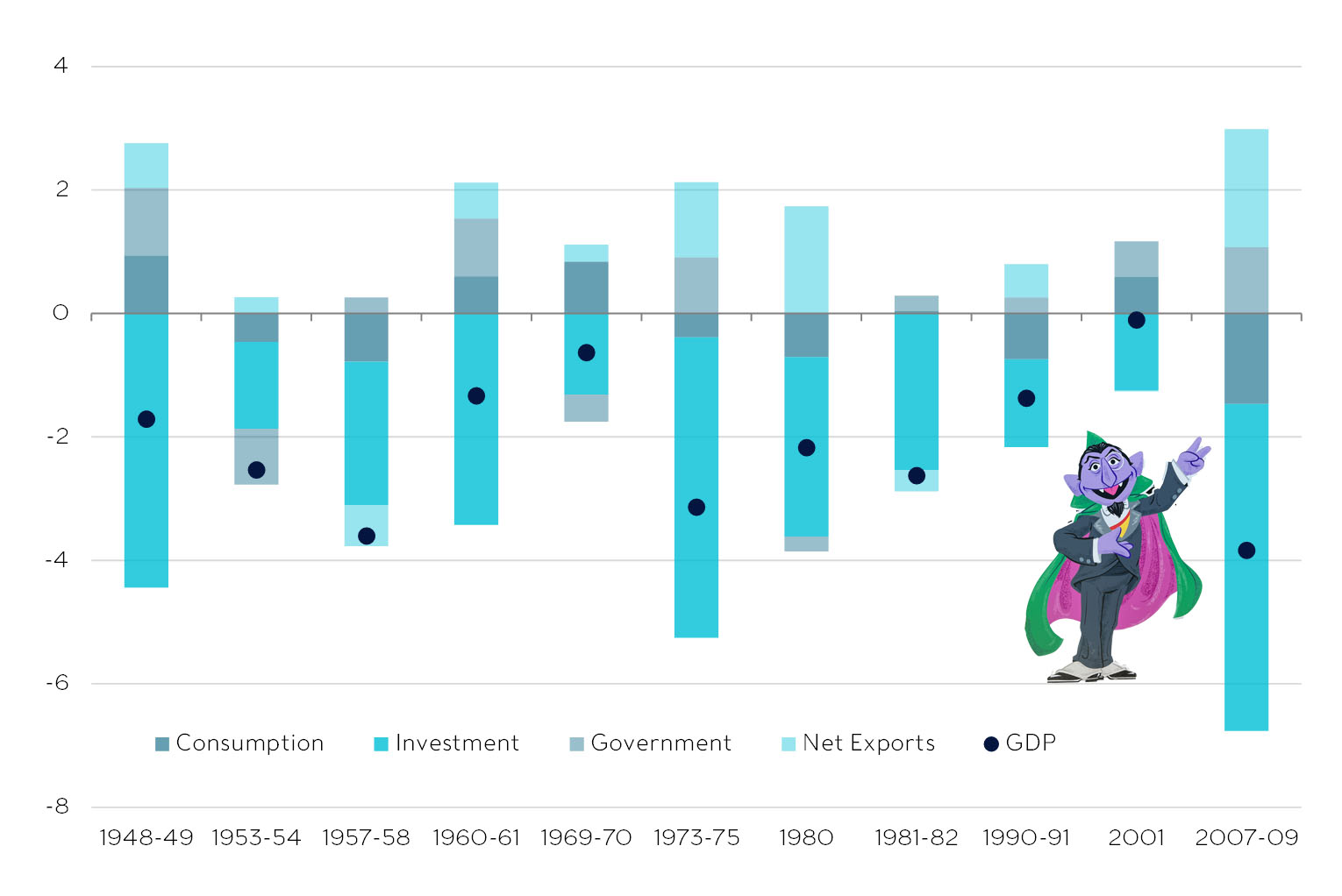

Investment is typically the swing factor that determines whether or not the US crumples into recession – and how deep that recession will be. Cutbacks in investment were a particularly large detractor in the last recession, just look at chart 3, ah, ah, ha …

Estimated contributions to GDP during US recessions

Sources: Refinitiv, Rathbones; note: 2001 trough taken as Q3

Although, household consumption is helping buoy economic growth for now. Good thing there’s Halloween to keep people spending, ah, ah, ah. As long as they don’t put too much on the credit card. Average interest rates charged on credit cards have increased rapidly this year, as shown in chart 4, ah, ah, ha …

Surging credit card interest rates could upend overleveraged households

More Americans are defaulting on their credit card bills, but at rates that are miles below where they used to be before interest rates sunk into the catacombs after the Global Financial Crisis. Whether the spooky acceleration continues or levels off is yet to be seen. All we have is chart 5, ah, ah, ha …

US credit card delinquency rate (%)

Sources: Refinitiv, Rathbones

Good luck trick or treating from your friend, Bryn Jones Count von Count! Although, if you’re planning on using finance charts to scare the neighbourhood, your kids will go hungry, ah, ah ha ...