Economic and market insight

Review of the week

Review of the week: Goodbye to all that?

UK inflation is below the central bank’s 2% target for the first time in three and a half years. That should clear the way for further cuts to interest rates.

1 min

Review of the week: France cuts spending, ECB to cut rates?

The twin engines of the European economy, Germany and France, are sputtering. With inflation falling and France turning to austerity, will the central bank come to the rescue?

1 min

Review of the week: Jobs bounce back

America’s fading jobs market reversed course last month, with a surge of new jobs created. What does this mean for the path of interest rates?

1 min

Review of the week: The return of the dragon

The year of the dragon hasn’t been an auspicious one for China so far. Its leaders are trying to turn that around with a wall of money to kickstart its sputtering economy.

1 min

Review of the week: The Fed goes big

Interest rates have finally dropped in the US after a double-barrelled cut. But will they fall as fast from here as investors expect?

1 min

Review of the week: Painting a picture

The wait for US interest rate cuts is over. Everyone expects the US Federal Reserve to move this week, the question is how far will it go?

1 min

Review of the week: The comfort blanket of lower interest rates

Stocks are down on underwhelming US economic numbers, but the central bank is likely to ride to the rescue.

1 min

Review of the week: Sudden market jolt gives way to tentative calm

Markets started wild as recession fears rose, yet became more orderly as last week progressed. Will the calm remain?

7 mins

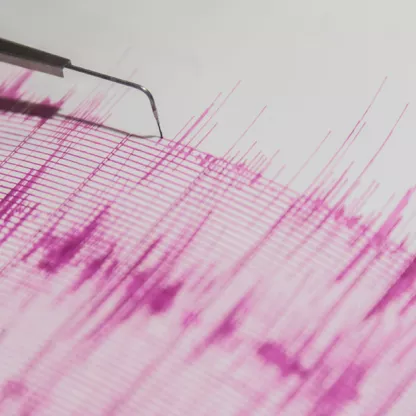

Review of the week: A seismograph for US economic tremors

Stock markets around the world are being rocked as investors take fright about whether America is headed for recession in the coming months. Yet why is Japan the epicentre?

8 mins

Review of the week: Time to cut?

After months of waiting, there’s a strong chance that interest rates may fall in the UK this week. Across the Atlantic, the longed-for cuts won’t be till the autumn, if markets are correct.

6 mins

Review of the week: Biden bows out

After weeks of pressure, President Joe Biden has abandoned his bid for re-election. Will there be a battle for the Democratic nomination at next month’s party convention in Chicago, or will his successor be coronated quickly?

7 mins

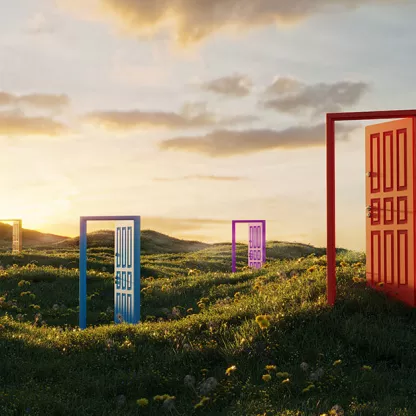

Review of the week: Is the door opening to us rate cuts?

Political violence in the US is overshadowing last week’s big moves in the biggest US stocks, and widespread gains for smaller stocks too.

6 mins

Rolling with the devil

Whether rolling cheese down a hill, braving the chaos of a Spanish fiesta or investing in the stock market, you should always take precautions, argues Will McIntosh-Whyte, assistant manager of our multi-asset funds.

3 mins

UK financials – back from the brink

Ten years on from the nationalisation of virtually the whole UK banking sector, it’s now a much safer place to invest. Banks may not be the racy investments they were pre-crisis, but David Coombs, our head of multi-asset investments, explains why boring may be good when it comes to banks.

4 mins

Cheaper bonds mean cheaper stocks

A hefty jump in US Treasury yields seems the most likely reason for October’s abrupt sell-off. But chief investment officer Julian Chillingworth finds it hard to believe the US economy is about to keel over, given recent data, and believes equities – while volatile – should remain the place to be for the foreseeable future.

5 mins

The double-edged sword of longevity

People may be living longer than before, but many of them still routinely underestimate how long they might live. And that means there's a very real risk that they could outlive their retirement funds altogether.

3 mins

Hope and glory

In some ways, the US and UK are more alike than ever: both are wrestling with their identities as nations. And yet the Special Relationship is a study in contrasts economically, notes chief investment officer Julian Chillingworth.

4 mins

Diamonds in the Bo…rough

Will McIntosh-Whyte, assistant manager of our multi-asset funds, finds a few hidden gems while exploring his new digs in zone one. He found another in Wisconsin, USA.

3 mins

A brand new world: why millennials matter

Rathbones’ head of equity research Sanjiv Tumkur discusses how the next generation is steering consumer trends, and why millennials matter for investors of all ages.

4 mins

A brand new world: challenges to established brands

Companies selling big global brands have come to be known as ‘dividend aristocrats’ because of their long track records of stable earnings power. Rathbones’ head of equity research Sanjiv Tumkur discusses how these ‘branded gentry’ are under threat in a rapidly changing consumer landscape, and how some are adapting.

4 mins

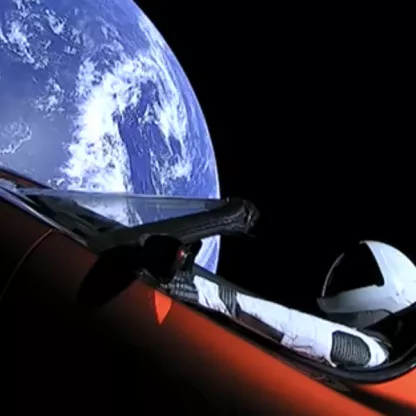

Beware the guru

Elon Musk has got himself in hot water with the SEC after months of erratic behaviour. Our head of multi-asset investments, David Coombs, ponders the effects of hubris.

3 mins

It’s the real (skinny) thing

Coca-Cola’s purchase of Costa Coffee is a smart move away from sugar and gives the company plenty of options, argues head of multi-asset investments David Coombs. And the growth in coffee sales may surprise you …

4 mins

Underneath the arches

David Coombs, our head of multi-asset investments, has been watching too much EastEnders. But it’s got him thinking about how assets can be dressed up as something else.

3 mins

Automation for the nation: the future of finance

Artificial intelligence (AI) is infiltrating every area of modern life, from voice recognition devices like Alexa to driverless cars. And financial technology is not immune from the relentless march of AI either.

3 mins