Rathbone Investment Management, one of the UK’s leading providers of investment management services for individuals, charities and professional advisers, is pleased to announce the launch of a new range of client propositions, which will invest in the underlying funds in the Rathbone Greenbank Portfolio Range.

Rathbone Investment Management expands access to Rathbone Greenbank Portfolio Range for advisers

Article last updated 2 December 2021.

Name

Relationship

Channel

Minimum

investment

Greenbank LED MPS

(G LED MPS)

Execution only

Adviser

£15,0001

Greenbank LED Managed

(G LED Managed)

Discretionary

Adviser

£150,000

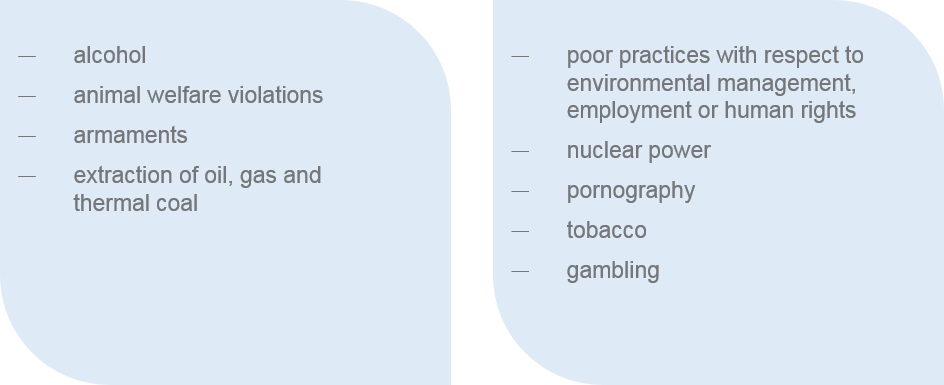

1£9,000 for Junior ISAs 2For further details about the Rathbone Greenbank Global Sustainability Fund, please visit this link 3For further details about the Rathbone Greenbank Multi-Asset Portfolios, please visit this link 4The Rathbone Greenbank Multi-Asset Portfolios will not invest in companies materially involved in: Habitats and ecosystems

Includes organisations that are helping to preserve land, water and marine habitats and biodiversity.

Resource efficiency

Includes organisations that are supporting the sustainable use of Earth’s resources through the products and services they provide. It also includes organisations that are operationally aligned with the theme and support positive impacts via their policies, business strategies and management of their own resource use.

Decent work

Habitats and ecosystems

Includes organisations that are helping to preserve land, water and marine habitats and biodiversity.

Resource efficiency

Includes organisations that are supporting the sustainable use of Earth’s resources through the products and services they provide. It also includes organisations that are operationally aligned with the theme and support positive impacts via their policies, business strategies and management of their own resource use.

Decent work

Includes organisations that are supporting the quantity and quality of jobs through the products and services they provide.

Also includes organisations that are operationally aligned with the theme and support positive impacts via their policies, business strategies and management of their own employment practices.

Inclusive economies Includes organisations that are promoting access to basic services and supporting a more inclusive society through the products and services they provide. Energy and climateIncludes organisations that are supporting positive climate action and energy security through the products and services they provide.

Also includes organisations that are operationally aligned with the theme and support positive impacts via their policies, business strategies and management of their own environmental impacts

Health and wellbeing Includes organisations that are supporting physical and mental wellbeing, or helping to prevent injuries and deaths, through the products and services they provide. Resilient institutions Includes organisations that promote peace, justice and the rule of law through the products and services they provide. It also includes organisations that are operationally aligned with the theme and support positive impacts via their policies, business strategies and management of their own human rights impacts. Innovation and infrastructure Includes organisations that are supporting environmental sustainability or human wellbeing through the products and services they provide. Organisations in this theme can often play a facilitating role in creating the environment or infrastructure needed for other organisations to deliver positive impact.Companies must also align with one or more of the above sustainable development themes via their core products and services or the way in which they operate.

For further information, please visit here.

About Rathbones Group Plc

Rathbones provides individual investment and wealth management services for private clients, charities, trustees and professional partners. We have been trusted for generations to manage and preserve our clients’ wealth. Our tradition of investing and acting responsibly has been with us from the beginning and continues to lead us forward.

- In business since 1742.

- A FTSE 250 listed company.

- Managing/administering more than £55.8* billion for our clients.

- 15 offices throughout the UK and Jersey.

*as at 5 April 2021. Includes funds managed by Rathbone Unit Trust Management.

For more information about Rathbons Group Plc, please visit rathbones.com

Our purpose at Rathbones Group Plc

We see it as our responsibility to invest for everyone’s tomorrow. That means doing the right thing for our clients and for others too. Keeping the future in mind when we make decisions today. Looking beyond the short term for the most sustainable outcome. This is how we build enduring value for our clients, make a wider contribution to society and create a lasting legacy. Thinking, acting and investing responsibly. Find out more.

Rathbone Investment Management Limited is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Registered office: Port of Liverpool Building, Pier Head, Liverpool L3 1NW. Registered in England No. 01448919.

Rathbone Investment Management’s Head Office is 8 Finsbury Circus, London EC2M 7AZ.

Rathbone Unit Trust Management Limited is authorised and regulated by the Financial Conduct Authority. A member of the Investment Association. Registered office: 8 Finsbury Circus, London EC2M 7AZ, Registered in England No. 02376568.

About Rathbone Greenbank Investments

Rathbone Greenbank Investments specialises in creating bespoke ethical, sustainable and impact portfolios on behalf of its individual, charity and professional adviser clients. Greenbank manages over £2 billion of funds (as at 5 April 2021) and is part of Rathbone Investment Management Limited.