We expect inflation to start to fade in the second half of the year, allowing central bankers to keep their foot on the accelerator with loose monetary policy.

It’s not time to reduce equities but look for inflation sensitivity

Article last updated 19 February 2023.

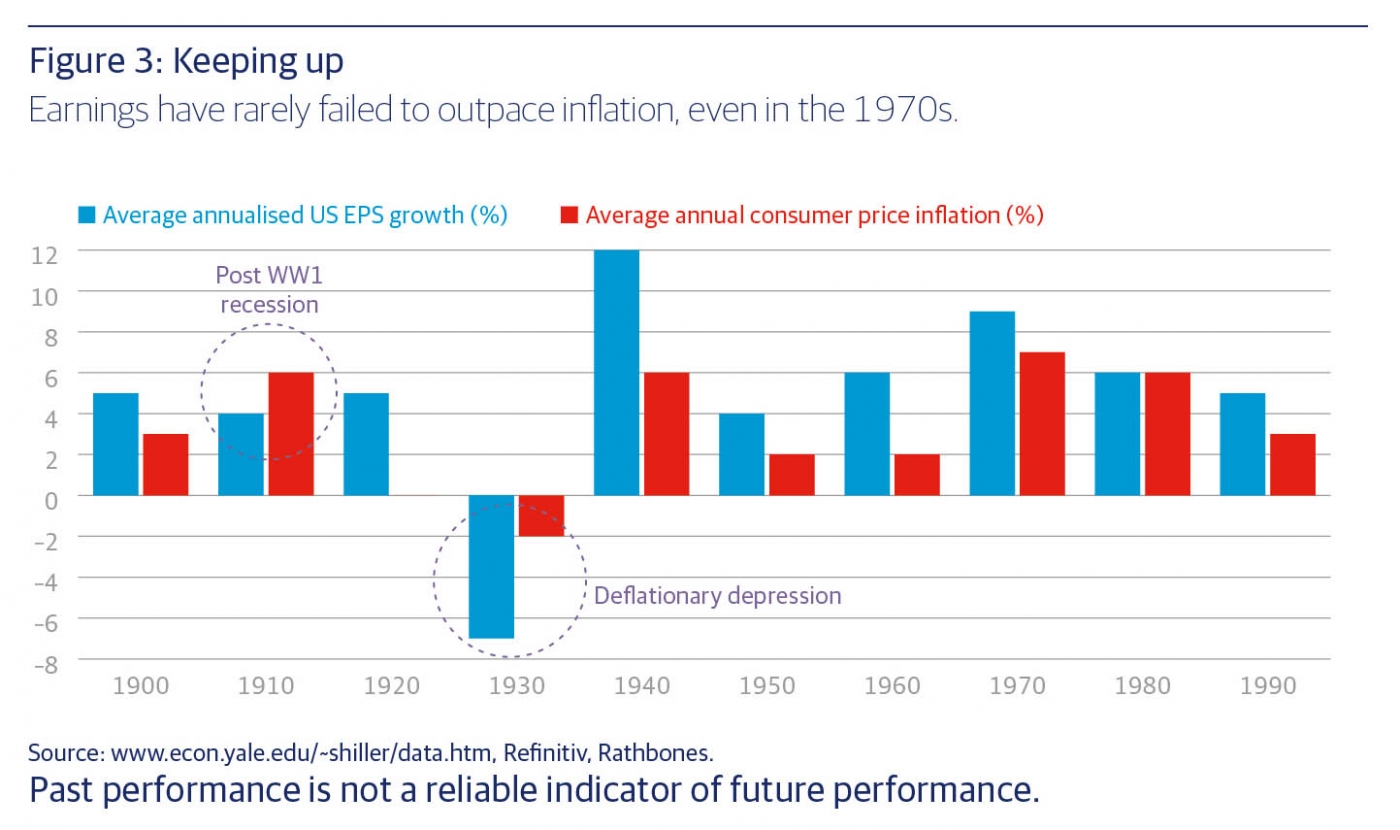

But even with our view that inflation will settle into a higher range than where it was pre-COVID, equity investors can take further comfort from our historical analysis showing that profits have rarely failed to keep pace with inflation.

In the higher-inflation times of the 1970s and 1980s, and even in the beleaguered UK, companies still managed to deliver profit growth in real (inflation-adjusted) terms (figure 3). But while earnings tend to be able to cope with inflation, it’s valuations that can suffer if real rates rise, increasing the discount applied to expected future earnings. This is not our base case. Furthermore, our analysis shows valuations have already built in a buffer against an increase of about half a percentage point in real rates.

Have cyclicals had their day in the sun?

In anticipation of a strong post-COVID rebound, we noted last summer that it made sense to shift towards good-quality, cyclical companies. These types of businesses are well managed with sound financials and stand to benefit from the upturn in the economic cycle.

Leading economic indicator (LEIs) are now near all-time highs. We believe they are likely to stay elevated due to the nascent boom in capital spending, inventory rebuilding and the ongoing resumption of activity in the service sector as economies open up more fully.

"Early on in the recovery from the pandemic we didn’t think it was the right time to shift towards value. So what’s changed?"However, there is a risk that these elevated LEIs could start to roll over. While we don’t see this as the most likely scenario, if it were to happen it could mean a change of leadership away from cyclicals, which are now looking very expensive after an unprecedentedly strong run.

As LEIs have risen, so-called value shares (with cheaper valuations) have also outperformed more expensive growth companies whose earnings tend to be strong across economic cycles, such as big tech. However, value and cyclicality can decouple. Stocks that tend to do well in periods of rising inflation or bond yields have also outperformed this year, but we think there is more scope for this to continue.

A record-breaking run

These stocks are more likely to be found in those sectors with a higher representation in value indices, particularly financials and energy — which Europe has a lot of (see article on page 8). Indeed, the record-breaking run of cyclical shares versus defensives has already started to peter out in the last two months, while value still has a very long way to go before it regains ground on the broader market.

Early on in the recovery from the pandemic we didn’t think it was the right time to shift towards value. So what’s changed? Risks to a post-COVID reopening have dissipated, while risks from rising real yields and inflation have risen substantially. The fact that we are exiting a decade of inflation averaging below 2% and entering a phase of above target inflation (which we think is likely to last until the end of 2022) is a profound change that equity investors need to note. We think value stocks that tend to do well in periods of rising inflation and bond yields could continue to outperform over the next year. But in the longer term we still see a lot of structural headwinds limiting the upside for financials and energy stocks.

This article has been taken from, 'Q3 2021 Investment Insights', read the full publication here.