Chart of the week: Serving all stakeholders is all the rage

But is it more than just lip service?

1 min

Unlearning what you think you know about government budgets

Government budget balances are misunderstood. By politicians — sometimes wilfully — and even by some economists. So it’s no wonder then, if they’re misunderstood by the public.

3 mins

Review of the week: Fisheries and finance

Will the pull of the heart prevail against the mind in Brexit negotiations? Will a nasty outbreak of flu be the start of a beautiful friendship between Trump and Xi? Chief investment officer Julian Chillingworth is dubious.

7 mins

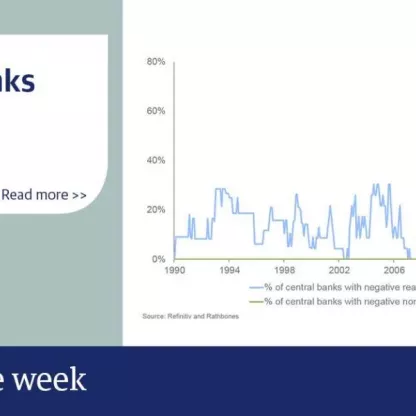

Chart of the week: Central banks need help

Will governments provide a boost?

1 min

Rathbone Global Opportunities Fund - Extended video

James Thomson, who has managed the Rathbone Global Opportunities Fund for over 15 years, deep dives into another successful year which saw the fund outperform the sector, with a first quartile positioning.

1 min

Rathbone High Quality Bond Fund

We aim to preserve your capital and pay an income by delivering a greater total return than the Bank of England's Base Rate + 0.5%, after fees, over any rolling three-year period. Total return means the return we receive from the value of our investments increasing (capital growth) plus the income we receive from our investments (interest payments). We use the Bank of England's Base Rate + 0.5% as a target for our fund’s return because we aim to provide a return in excess of what you would receive in a UK savings account.

This is an investment product, not a cash savings account. Your capital is at risk.